Ministry of Finance / Tax Authorities

Solutions for entrepreneurs with tax debt after corona

Many companies that were doing fine before the corona crisis now face a hefty tax debt. They fear that paying the deferred taxes will lead to bankruptcy. These payments are in addition to other rapidly rising costs.

Challenge for entrepreneurs and government

Paying back accumulated debts leads to problems: stress and uncertainty among entrepreneurs, and a peak workload at the tax authorities. Therefore Informaat was asked a twofold question: How can we optimally align policy and implementation for the settlement of corona debts with the needs and expectations of entrepreneurs? And how can we cope with a possible peak load in the handling of requests for reorganization and business termination?

The solutions must be in line with the five core values: fair, proactive, entrepreneurial, reliable and transparent.

Real people behind the figures

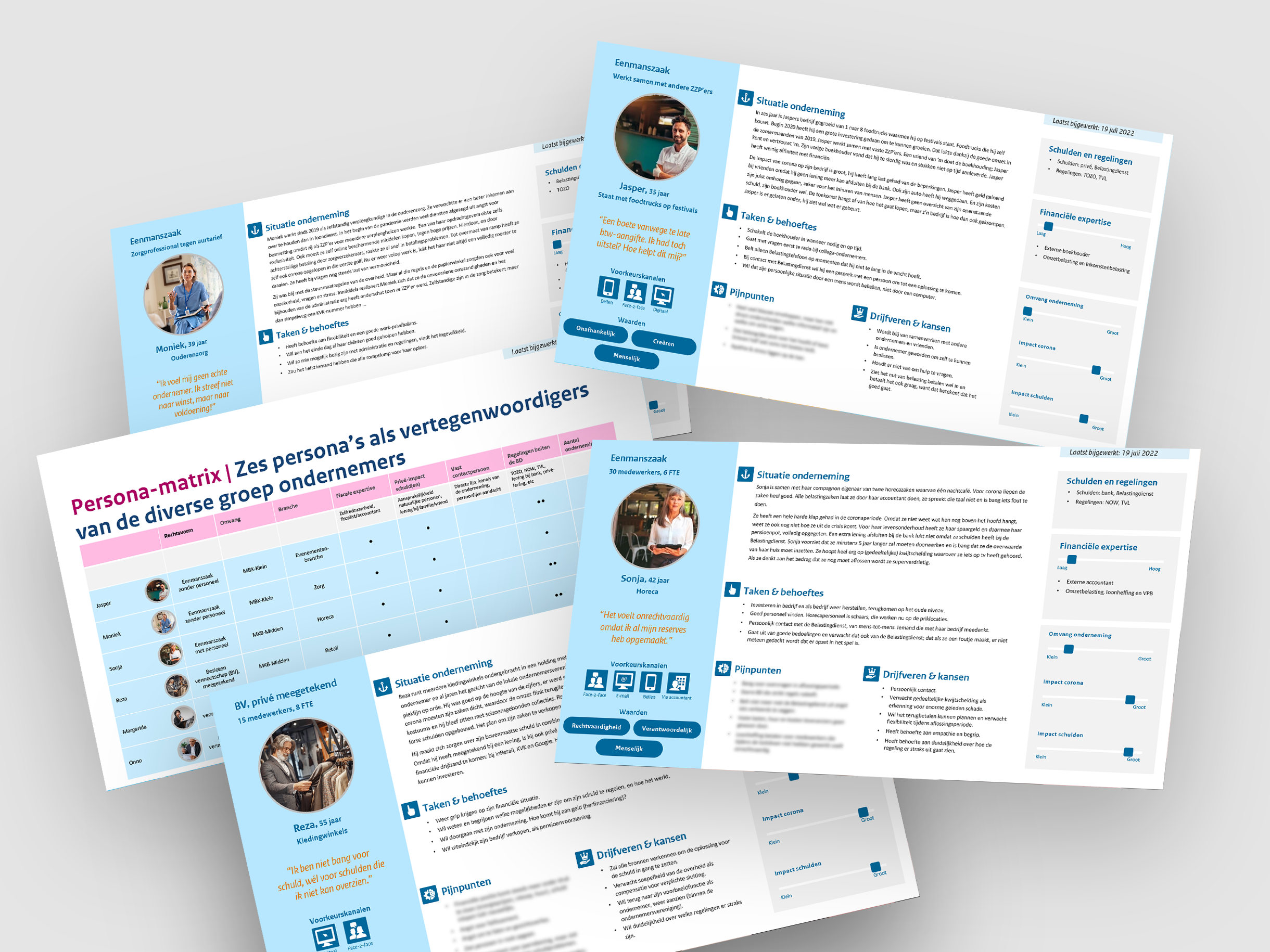

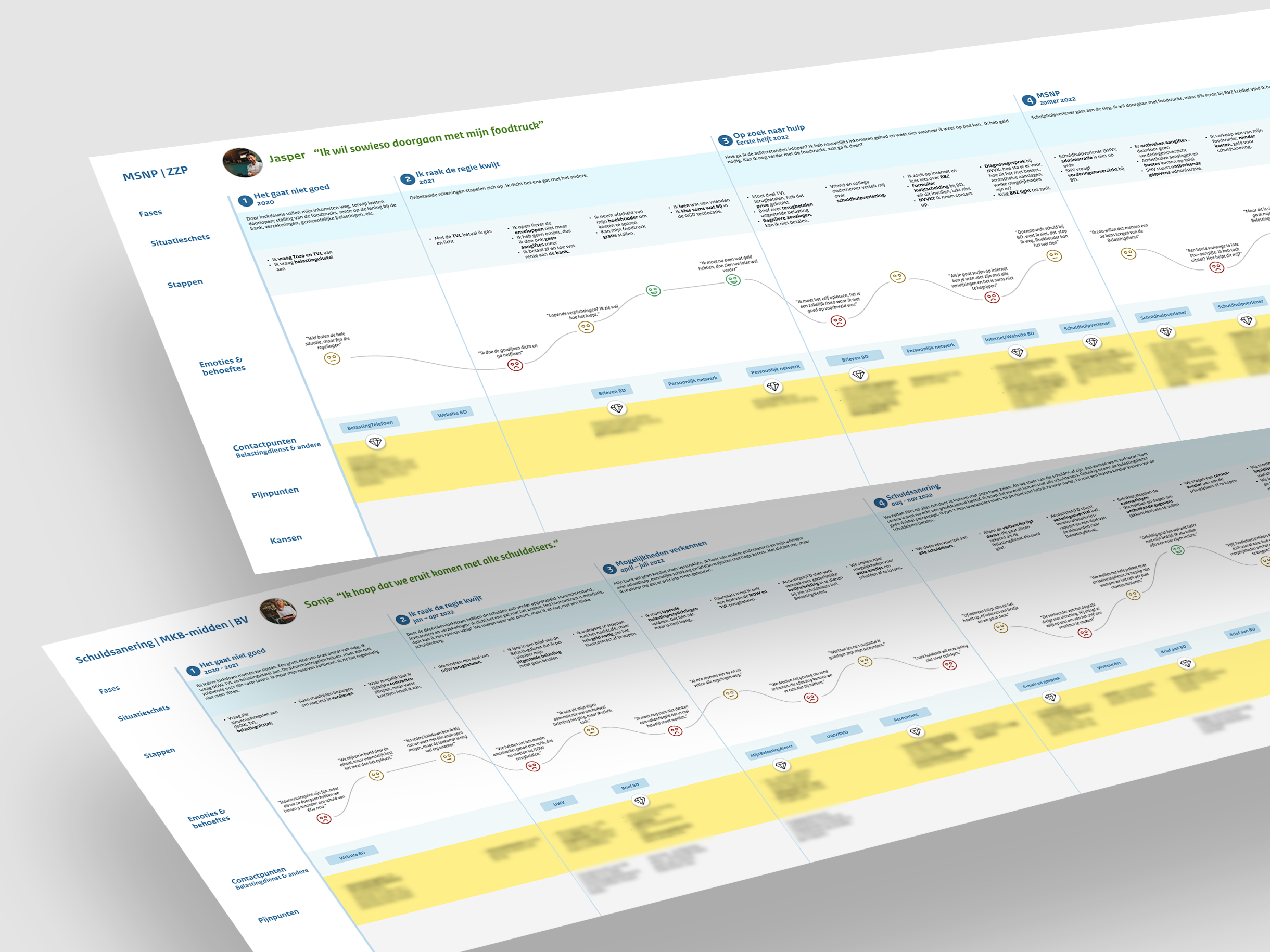

280,000 entrepreneurs have a total of 19 billion tax debts after the corona pandemic. We went looking for the personal stories behind these anonymous figures and took these 'from the outside inwards' to the Tax Authorities. A first series of interviews quickly showed that many entrepreneurs have not only accumulated debts with the tax authorities during the corona crisis, but also with their bank, landlord, supplier and family. We saw shame and even fear: entrepreneurs who no longer respond to mail or do not dare to call the tax authorities for fear of saying something wrong.

"All my pension and savings gone. It is not our fault that the business had to be closed. It's so unfair."

Focus on the most vulnerable group

It also quickly became clear that 'the entrepreneur' does not exist. After all, the target group is very diverse, ranging from self-employed private persons to large international companies. Some sectors have also been hit harder financially than others. That is why we quickly put priority on companies with little or no tax expertise, where debts have a big private impact.

From relaxed policy to calculating repayment schedule

In co-design sessions with this specific group of entrepreneurs, their umbrella organisations and officials from the Ministry of Finance and the Tax Authorities, we translated the core insights from our research into practical solutions. These range from input for new government policies - such as flexibility in repayments, a pause button and other relaxations - to very practical digital tools.

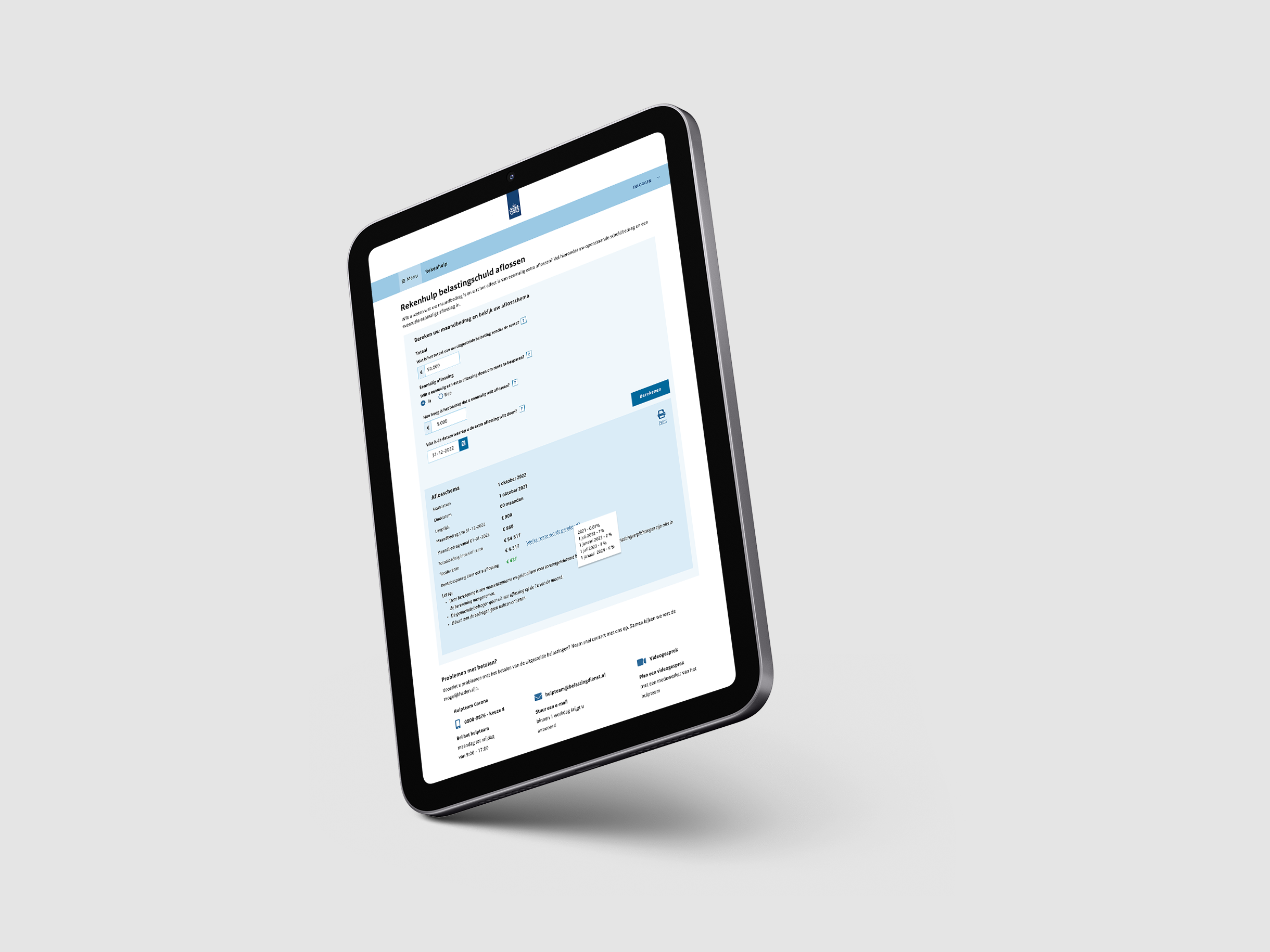

An example is a simple calculation tool with which entrepreneurs gain timely insight into the maximum term of their repayment, the monthly amount and interest. Or a redesign of the remediation process, including digital forms, in which the 'human factor' is guaranteed and the lead time for the treatment is as short as possible.

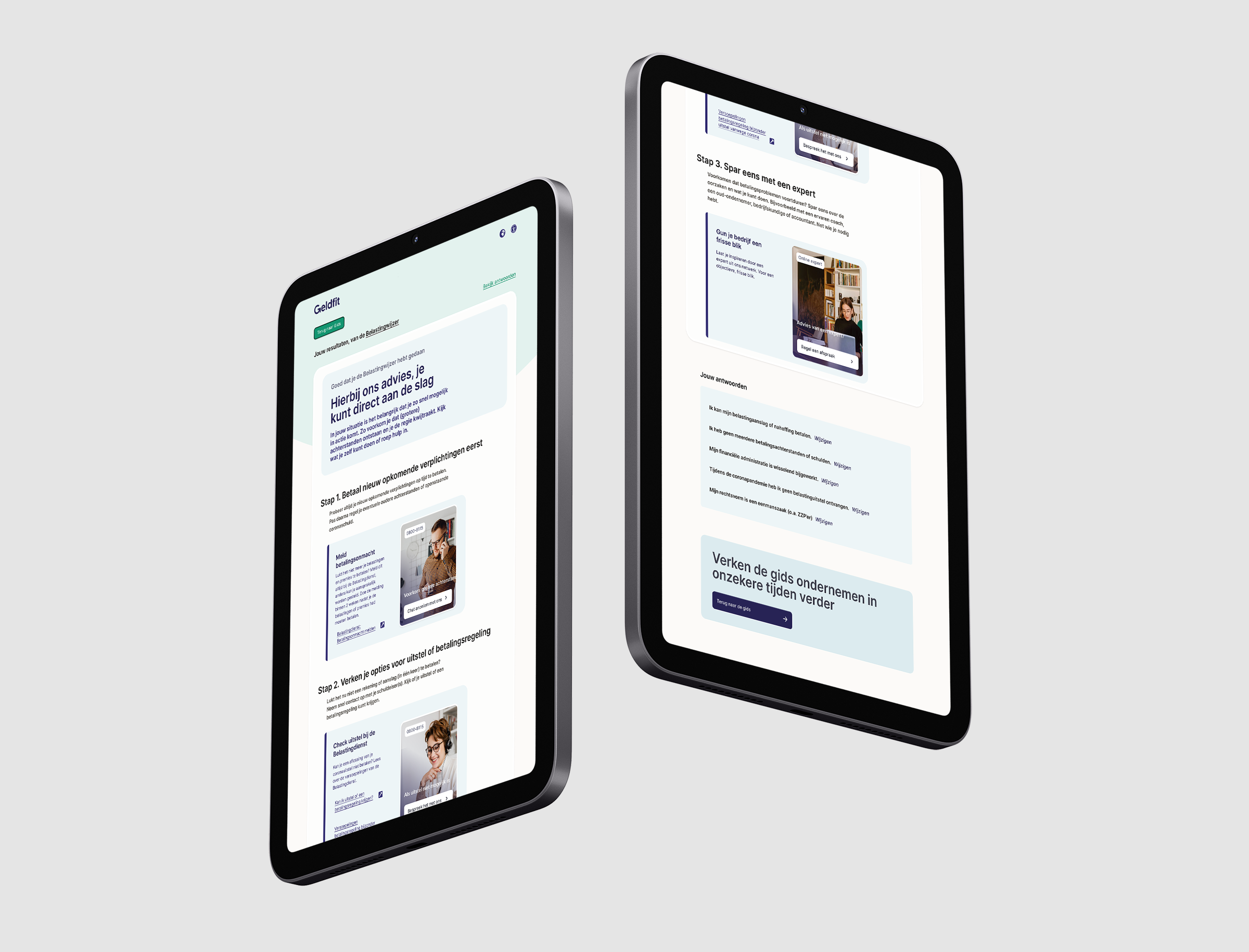

Unambiguous (debt) aid route via Geldfit

Entrepreneurs with money worries are usually not used to asking for help and the municipality is not a logical counter. Still, it’s important to tackle debts as early as possible so that they do not get out of hand. In collaboration with Geldfit / stichting Nederlandse Schuldhulproute (NSR), we have set up a pilot to reach entrepreneurs who have more debts than tax deferral alone. In order to be able to measure the degree of success, we have drawn up a measurement plan. Based on this, it will be decided whether the pilot will be converted into a (permanent) collaboration between NSR and the Tax Authorities.

Impact

We first worked out all the solutions (in prototype), validated them with entrepreneurs and then further refined them. Both entrepreneurs and civil servants were very positive about the content, design and functionality of the service. During and after the corona crisis, thousands of entrepreneurs made use of this.

Our design thinking approach, in which the perspective of the entrepreneurs is brought in from the outside, is considered very successful by the Tax Authorities. The insights have also been used to increase the empathy of employees for the situation of entrepreneurs. In order to guarantee this permanently, we have made a start with a customer panel and regular consultations are planned with other creditors and with umbrella organizations (such as VNO-NCW, MKB-NL, ZZP Nederland).

Curious about this project? Feel free to contact us.

Want to make an impact with service design?

Marcel Kosters

Business director